Request A Call Back

Register Real Account

Register Demo Account

Natural Gas Bolstered Above $4.000 Levels, U.S Shares at Record Highs & Awaiting for U.S FOMC Meet

By Research Team Monday, Jul 26, 2021

- 9.55am ISTD1

- High1.37639

- Low1.37405

- Close1.37551

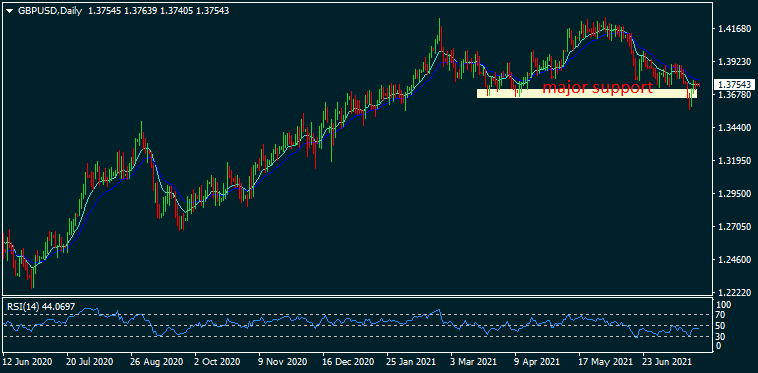

GBP/USD is trading at 1.37479, 0.01% up since Friday. The steady USD ahead of FOMC meeting turned positive for other global currencies. Last week, the Pound depreciated massively after U.Ks showed worst effect of rising number of Delta variant Covid-19 cases which hamper its economic growth. Also, the weaker than expected PMI figures soared down the GBP/USD slightly. Globally, the growing optimism over global growth remained supportive for major currencies. As seen in the chart, the pair formed double bottom & rallied back to MA (10). This indicates the chances of breakout if breached the levels; testing the next level of 1.38000 otherwise a reversal can be expected.

Read More… Read LessDaily Outlook

GBP/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.38694 |

| R2 | 1.38096 |

| R1 | 1.37796 |

| Turnaround | 1.37498 |

| S1 | 1.37198 |

| S2 | 1.36900 |

| S3 | 1.36300 |

By Research Team Monday, Jul 26, 2021

- 10.14am ISTD1

- High15877

- Low15721

- Close15871

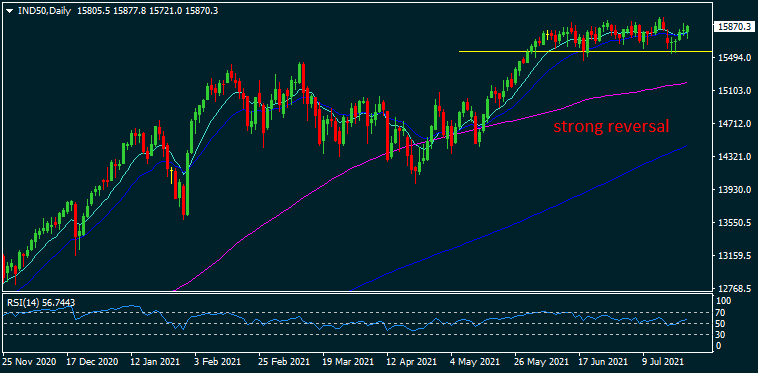

INDIA50 is trading at 15857, 0.26% up since previous day close. Strong buying can be seen in SGX Nifty as the index in on the verge of entering a new territory range if breached the current levels. The robust U.S & Indian corporate earnings & the progressive trails against Delta variant virus remain supportive for INDIA50. Moreover, a progress in Covid-19 vaccination drive across the country makes the INDIA50 more attractive in long term. The volatile Oil prices strengthen the INR; which further pushes up the INDIA50. Upcoming event of FOMC meet in the next week will be closely monitored. As seen in the chart, the strong reversal from major support level of multiple previous lows makes indicates a buying bias with a target of 15950 levels on short term basis.

Read More… Read LessDaily Outlook

INDIA50

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 16104.00000 |

| R2 | 15965.00000 |

| R1 | 15893.00000 |

| Turnaround | 15826.00000 |

| S1 | 15754.00000 |

| S2 | 15687.00000 |

| S3 | 15548.00000 |

By Research Team Monday, Jul 26, 2021

- 10.35am ISTD1

- High4.045

- Low3.947

- Close4.011

Natural gas is trading at $4.011, 0.42% up since previous close. A sharp rally can be seen in Natural gas prices crossing multi year high of $4.000 levels amid a considerable increase in consumption demand against the steady supplies. Last week, the Energy Information Administration (EIA) report showed a build-up in Natural gas storage levels by 49B; still lower than preceding reading of 55B which pushed up the prices. Also, the change in climatic conditions in U.S & European regions remains a supportive factor for energy prices. As seen in the chart, the commodity widely crossed last resistance level of ‘e’, indicating buying bias on an intraday basis with a next target of $4.050-$4.100 levels.

Read More… Read LessDaily Outlook

Natural Gas

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 4.19700 |

| R2 | 4.09900 |

| R1 | 4.05500 |

| Turnaround | 4.00100 |

| S1 | 3.95700 |

| S2 | 3.90300 |

| S3 | 3.80500 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms (XFLOW & MT4) with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2023 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UK: +44 20 38355241 | Dubai: +971 54 339 3959 Working hours: 7:00 AM - 5:00 PM (GMT+0)

Deutsch

Deutsch

Русский

Русский

Polski

Polski

中文

中文

Melayu

Melayu

Indonesian

Indonesian

ภาษาไทย

ภาษาไทย

Tiếng Việt

Tiếng Việt

Hindi

Hindi

ភាសាខ្មែរ

ភាសាខ្មែរ

العربية

العربية