Request A Call Back

Register Real Account

Register Demo Account

Ongoing U.S Banking Crisis Widened, Upcoming U.S CPI Data Release & Shining Precious Metals

By Research Team Tuesday, Mar 14, 2023

- 9.05amD1

- High0.66547

- Low0.66317

- Close0.66434

AUD/USD is trading at 0.66391, 0.21% up since previous day close. The Aussie seems to be trading in a specific range post release of Westpac Consumer Sentiment which failed to show any changes against -6.9%. The NAB Business Confidence fell by 4 against build-up of 6 in the previous month. The market will be looking forward to the result of country’s Employment data later in this week. On global front, the panic looms over SVB & Signature banks closure in U.S; affecting an overall banking system. This turned out to be negative for USD & positive for other currencies. As seen in the chart, the pair formed double bottom & seems to be sustaining the same. Slight buying bias may be recommended in AUD/USD further.

Read More… Read LessDaily Outlook

AUD/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 0.68884 |

| R2 | 0.67731 |

| R1 | 0.67141 |

| Turnaround | 0.66578 |

| S1 | 0.65998 |

| S2 | 0.65425 |

| S3 | 0.64272 |

By Research Team Tuesday, Mar 14, 2023

- 9.25amD1

- High7560

- Low7541

- Close7556

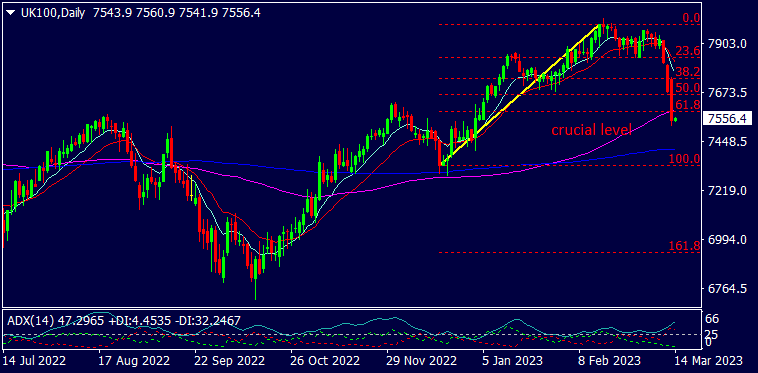

UK100 is trading at 7557, 0.11% down since previous day close. The panic selling in U.S & European shares led downside in UK100 as ongoing U.S banking crisis widened overnight. On Sunday, the U.S administration stepped in with emergency measures in to order to limit the consequence from sudden collapse of SVB Financial Group & allowed its depositors to access their money from today onwards which eased down market fear to some extent. However, uncertainty still looms over banking system & Fed’s next monetary decisions. The U.K is to issue its Claimant Count Change data today. As seen in the chart, the index is trading at MA (100) which acts as major support level & indicates the chances of reversal if sustained. Slight selling bias may be suggested for the day in UK100.

Read More… Read LessDaily Outlook

UK100

| Intra Day | |

| Near Day |  |

Technical Levels

| R3 | 8050.00000 |

| R2 | 7827.00000 |

| R1 | 7685.00000 |

| Turnaround | 7604.00000 |

| S1 | 7462.00000 |

| S2 | 7381.00000 |

| S3 | 7158.00000 |

By Research Team Tuesday, Mar 14, 2023

- 9.42amD1

- High21.854

- Low21.631

- Close21.66

Silver is trading at $21.668, 0.06% up since previous close. The precious metals continued to show positive momentum since last few sessions against the weaker USD amid ongoing banking crisis in U.S after three major financial institutions collapsed last week. The U.S announced emergency measures to control the negative effects of SVB Financial Group crisis & also, allowed its depositors to access their money with SVB. The chances of slowdown in interest rate hikes in the Fed’s next meeting further pushed up the Silver. The outcome of U.S CPI data will be closely monitored today. As seen in the chart, the Silver reversed up from Fibo level 61.8 which acts as support level & hence, buying on dips may be seen further.

Read More… Read LessDaily Outlook

XAGUSD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 84.50000 |

| R2 | 79.63000 |

| R1 | 77.09000 |

| Turnaround | 74.68000 |

| S1 | 72.14000 |

| S2 | 69.73000 |

| S3 | 64.78000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UK: +44 20 38355241 Working hours: 7:00 AM - 5:00 PM (GMT+0)