Request A Call Back

Register Real Account

Register Demo Account

EUR/USD Eyes Support at 1.0800, US Futures Rebound Post-Fed, Gold Awaits Equity Market Fluctuations

By Research Team Wednesday, Mar 27, 2024

- 12:07D1

- High1.08306

- Low1.08242

- Close1.08303

EUR/USD is trading at 1.08300, 0.02% down since previous day close. EUR/USD is trading in negative territory for two consecutive days near 1.0830 due to renewed USD demand. The pair maintains a bearish outlook above the key EMA and RSI, with the first upside barrier near 1.0853 and potential support level at 1.0800. The key resistance level is near 1.0853, with a break above this level paving the way for a 100-period high. A potential support level is at the 1.0800 round mark, representing the lower limit of the Bollinger Band. As seen in the chart, the pair has broken support with strong bearish candle, hence downside moment is expected till major support.

Read More… Read LessDaily Outlook

EUR/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.0899 |

| R2 | 1.0870 |

| R1 | 1.0858 |

| Turnaround | 1.0841 |

| S1 | 1.0817 |

| S2 | 1.0795 |

| S3 | 1.0776 |

By Research Team Wednesday, Mar 27, 2024

- 1:05D1

- High18537

- Low18470

- Close18534

US100 is trading at 18480, 0.21% up since previous day close. U.S. stock index futures rose in evening deals on Tuesday, signaling some recovery on Wall Street after three consecutive days of losses amid uncertainty ahead of more cues on inflation and the Federal Reserve. Nasdaq 100 Futures rose 0.2% to 18,485.0 points. Markets remain in a holding pattern until key inflation figures and Fed officials’ addresses. As seen in the chart, the index has a reversal resistance, downside is expected.

Read More… Read LessDaily Outlook

US100

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 18745 |

| R2 | 18620 |

| R1 | 18565 |

| Turnaround | 18502 |

| S1 | 18385 |

| S2 | 18300 |

| S3 | 18206 |

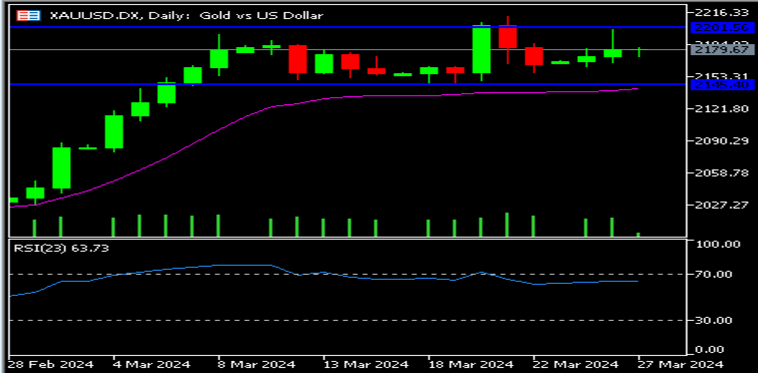

By Research Team Wednesday, Mar 27, 2024

- 2:35D1

- High2182

- Low2176

- Close2177

XAU/USD is trading at 2179.6, 0.05% up since previous day close. Gold price (XAU/USD) is struggling to gain momentum due to diverging forces, including doubts about the Fed’s three-time rate cuts this year and traders waiting for the release of the US Personal Consumption and Expenditure (PCE) Price Index data. The Fed’s projection of a less restrictive monetary policy and three rate cuts by year-end is a tailwind for the non-yielding Gold price. Russia’s increased attacks on Ukrainian energy infrastructure and Iran-backed Houthi militants have tempered investors’ appetite for riskier assets. As seen in the chart, market has been rejected from resistance could go upside for retest.

Read More… Read LessDaily Outlook

GOLD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 2229 |

| R2 | 2210 |

| R1 | 2197 |

| Turnaround | 2182 |

| S1 | 2164 |

| S2 | 2150 |

| S3 | 2164 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)