Request A Call Back

Register Real Account

Register Demo Account

Gold Edges Higher While Indices Remain Range Bound

By Research Team Friday, Jan 20, 2023

- 9.12amw1

- High0.64245

- Low0.63914

- Close0.6416

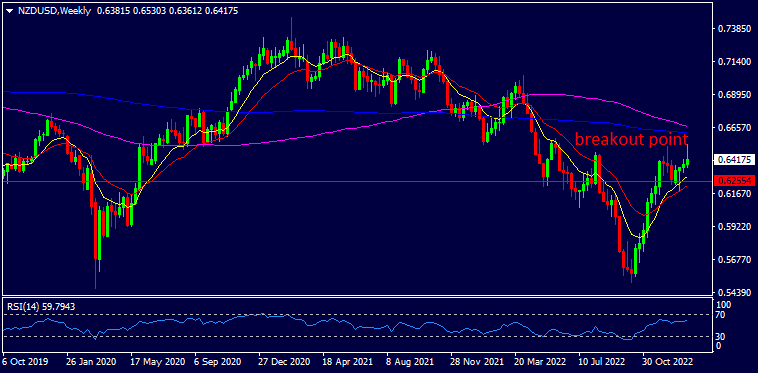

NZD/USD is trading at 0.64177, 0.02% up since previous day close. An upside resumed in Kiwi post correction seen in the previous trading session. On data front, the New Zealand’s Business NZ Manufacturing Index remained steady at 47.2 while the Visitor Arrivals grew by 43.1% from 6.8% in the prior month. On global front, the soft USD over chances of smaller interest rate hikes in the next Fed meeting led buying bias in the other basket of currencies. Improving Chinese economic conditions & easing down of Covid-19 restrictions further pushed up NZD/USD. As seen in the chart, the pair is strongly trading above the short term Moving Averages & further upside may make the pair to test MA (100) & MA (200).

Read More… Read LessDaily Outlook

NZD/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 0.657 |

| R2 | 0.64865 |

| R1 | 0.64407 |

| Turnaround | 0.6403 |

| S1 | 0.63572 |

| S2 | 0.63195 |

| S3 | 0.6236 |

By Research Team Friday, Jan 20, 2023

- 9.30amw1

- High26443

- Low26303

- Close26433

JAP225 is trading at 26373.8, 0.08% up since previous close. A slight upside can be seen in Asian shares on Friday amid mixed cues over interest rate hike stance in the Fed’s next meeting. Earlier, the U.S issued weaker Retail Sales data which dragged down the global markets. Globally, ongoing corporate earnings further contribute positive outlook in equity markets. The Bank of Japan (BoJ) left an interest rate steady at -0.10% & maintained its long term bond yields curve which slightly subdues the YEN & JAP225 as well. The Japan’s National Core CPI grew by 4.0% from 3.7% in the previous month. As seen in the chart, the index is trading within the sideways channel pattern & if took a support at lower trend-line, then a sharp move can be seen on higher side.

Read More… Read LessDaily Outlook

JAP225

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 27033 |

| R2 | 26698 |

| R1 | 26498 |

| Turnaround | 26363 |

| S1 | 26163 |

| S2 | 26028 |

| S3 | 25693 |

By Research Team Friday, Jan 20, 2023

- 9.48amw1

- High1934.9

- Low1928.39

- Close1928.89

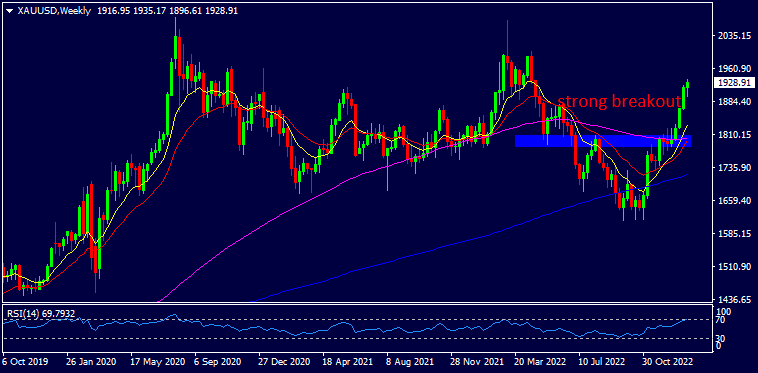

Gold is trading at $1929.05, 0.19% up since previous close. The higher highs can be seen in Gold prices on weekly basis as buying interest are growing up in commodity markets amid global cues. The mixed USD post release of soft U.S Retail Sales data & strong U.S Jobless Claims figures maintained an upside in precious metals. The Gold rallied on an account of better Chinese GDP figures, opening up of Chinese restrictions & lockdowns & rising chances of U.S smaller rate hikes in near term & improving labor data. The traders will be looking forward to the FOMC members’ speech today. As seen in the chart, a consistent upside in Gold makes the commodity to test the previous high of $1980 levels on short term basis.

Read More… Read LessDaily Outlook

GOLD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1991.03 |

| R2 | 1956.83 |

| R1 | 1944.28 |

| Turnaround | 1922.63 |

| S1 | 1910.08 |

| S2 | 1888.43 |

| S3 | 1854.23 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)