Request A Call Back

Register Real Account

Register Demo Account

Mayhem in Equities & Commodities Caps Positive Sentiments Amongst the Traders

By Research Team Monday, Sep 26, 2022

- 2.12pmW1

- High17200

- Low16951

- Close17083

INDIA50 is trading at 17071.3, 0.16% down since previous day close. The Asian shares seems to be trading flat to lower side after FOMC turned hawkish in future course of action with the possible chances of 75bps rate hike. The rising inflationary concern across the globe led the major Central banks to adopt aggressive monetary policy. Besides this, the rising geopolitical tension between Russia & Ukraine after the former ordered mobilization of reserve troops in an escalation of the war in Ukraine further suppressed the indices. Upcoming RBI meet & F&O expiry session will remain significant for index INDIA50. As seen in the chart, the index is hovering near major support level of MA (20) & hence, slight pullback may be seen if sustained the same.

Read More… Read LessDaily Outlook

INDIA50

| Intra Day | |

| Near Day |  |

Technical Levels

| R3 | 18311.00000 |

| R2 | 17812.00000 |

| R1 | 17504.00000 |

| Turnaround | 17313.00000 |

| S1 | 17005.00000 |

| S2 | 16814.00000 |

| S3 | 16315.00000 |

By Research Team Monday, Sep 26, 2022

- 2.30pmD1

- High1649.75

- Low1626.85000

- Close1645.52

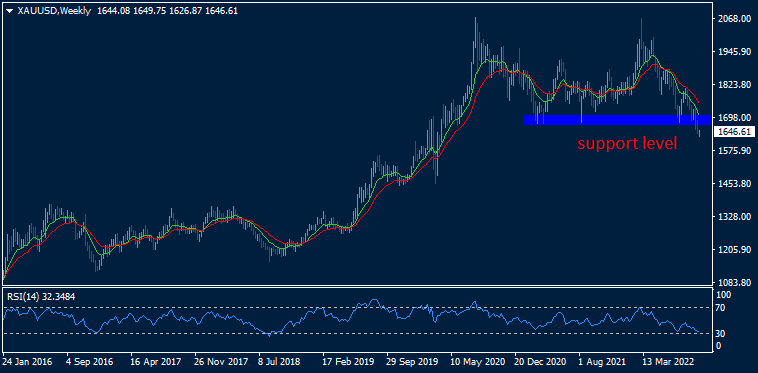

Gold is trading at $1644.98, 0.01% down since previous close. The Gold prices lowered down on Monday against the strong USD after Fed raised an interest rate by 75bps as expected; how-so-ever hinted for more aggressive rate hikes until year 2023 to get an interest rate above 4.00%. This heavily weighs down the commodities. Also, the rise in recession fear amid high inflation rate lowers down the consumption demand of Gold & other metals. The focus will remain on upcoming FOMC Powell speech due on Tuesday. As seen in the chart, the Gold is on the verge of crossing down the cluster support of multiple previous lows; however the RSI line is sustaining at lower level 30. Sideways trading may be seen for the day.

Read More… Read LessDaily Outlook

GOLD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1725.60000 |

| R2 | 1689.40000 |

| R1 | 1666.67000 |

| Turnaround | 1653.20000 |

| S1 | 1630.47000 |

| S2 | 1617.00000 |

| S3 | 1580.00000 |

By Research Team Monday, Sep 26, 2022

- 1.45pmW1

- High155.611

- Low154.657

- Close154.91

GBP/JPY is trading at 151.810, 0.26% down since previous day close. The GBP/JPY widely slid down on Monday against the strong USD Dollar Index amid aggressive Fed monetary stance in the near future. Besides this, the rising inflationary rate across the globe makes the major currencies to trade at lower levels. The U.K’s Rightmove HPI grew by just 0.7% against the previous figure -1.3% while the Japan’s Flash Manufacturing PMI fell to 51.0 against the expectation 51.3. The market will be looking forward to the Fed Powell speech due on Tuesday. As seen in the chart, the pair crossed down the short term Moving Averages & also, is hovering near cluster support of previous lows. This indicates the strong chances of selling bias on daily basis in GBP/JPY.

Read More… Read LessDaily Outlook

GBP/JPY

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 165.31100 |

| R2 | 158.59800 |

| R1 | 155.30500 |

| Turnaround | 151.88500 |

| S1 | 148.59200 |

| S2 | 145.17200 |

| S3 | 138.45900 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)