Request A Call Back

Register Real Account

Register Demo Account

Strong Euro-zone PMI Figures Boosted EURO, Indices Trades Steady While Oil Prices Inches Up

By Research Team Friday, Nov 24, 2023

- 9.53amd1

- High0.60574

- Low0.60445

- Close0.60559

NZD/USD is trading at 0.60500, 0.09% up since previous day close. The Kiwi seems to be trading stronger post release of Retail Sales data which showed no change in the figure against the expected fall of 0.8%; signaling for a progress in economic conditions. Globally, the mixed USD on account of suspicious view over Fed’s rate hike decision in near term led the buying pressure in EURO. The rising hopes over a rate cut in the year 2024 led the selling pressure in USD & U.S bond yields while this cushioned other basket of currencies. As seen in the chart, the pair is hovering near MA (200) & is heading towards upper trend-line of channel pattern. Buying on dips may be seen for the day in NZD/USD.

Read More… Read LessDaily Outlook

NZD/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 0.61371 |

| R2 | 0.60910 |

| R1 | 0.60695 |

| Turnaround | 0.60449 |

| S1 | 0.60230 |

| S2 | 0.59998 |

| S3 | 0.59527 |

By Research Team Friday, Nov 24, 2023

- 10.18amw1

- High35358

- Low35330

- Close35335

US30 is trading at 35336.3, 0.21% up since previous close. A strong upside can be seen in U.S markets as liquidity regains after remaining shut on Thursday on account of Thanksgiving Day. The traders & investors expect an interest rate cut in Fed’s forthcoming meetings which boosted up the U.S markets. The Chinese PBoC steps of leaving Prime Loan Rate steady & injecting the stimulus aid into financial system made the global equity markets to trade on higher side. The Jobless Claims data fell to 209K from 233K & the Consumer Sentiment reading rose to 61.3 from 60.4 in the previous month. As seen in the chart, the index is trading in a bullish channel pattern & hence, buying on corrective dips may be recommended for the day.

Read More… Read LessDaily Outlook

US30

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 35555.00000 |

| R2 | 35447.00000 |

| R1 | 35397.00000 |

| Turnaround | 35339.00000 |

| S1 | 35289.00000 |

| S2 | 35231.00000 |

| S3 | 35123.00000 |

By Research Team Friday, Nov 24, 2023

- 10.35amm1

- High1994.91

- Low1991.45

- Close1993.9

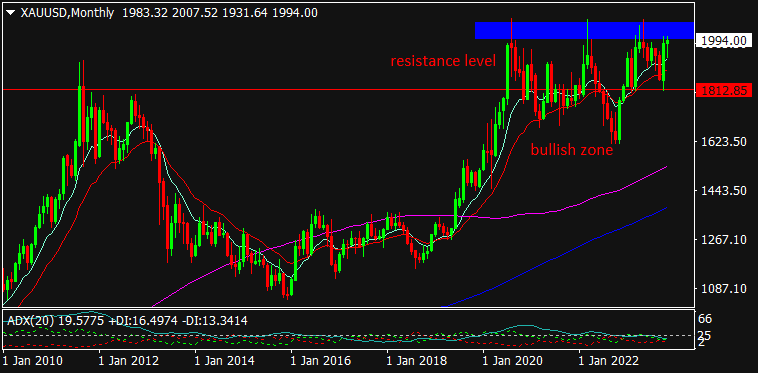

Gold is trading at $1993 .44, 0.04% up since previous close. An upward momentum sustains in the gold prices since last few sessions against the mixed USD as traders remain optimistic over less hawkish Fed future monetary stance. The Chinese move of injecting stimulus aid into financial system & leaving the Prime Loan Rate steady may increase the consumption demand of gold since China is a major consumer of metals. Ongoing tension between Israel & Hamas remains vital for precious metals. As seen in the chart, the gold is hovering near higher levels which acts as resistance level; signaling for a make-or-break situation on short term basis. Buying bias may be suggested for the day.

Read More… Read LessDaily Outlook

GOLD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 2011.54000 |

| R2 | 2002.85000 |

| R1 | 1998.47000 |

| Turnaround | 1994.16000 |

| S1 | 1989.79000 |

| S2 | 1985.47000 |

| S3 | 1976.76000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)