Request A Call Back

Register Real Account

Register Demo Account

Trading Idea on XAUUSD (Gold)

By Research Team Friday, Sep 15, 2023

- 3.02pmd1

- High1919.56

- Low1909.81

- Close1919.61

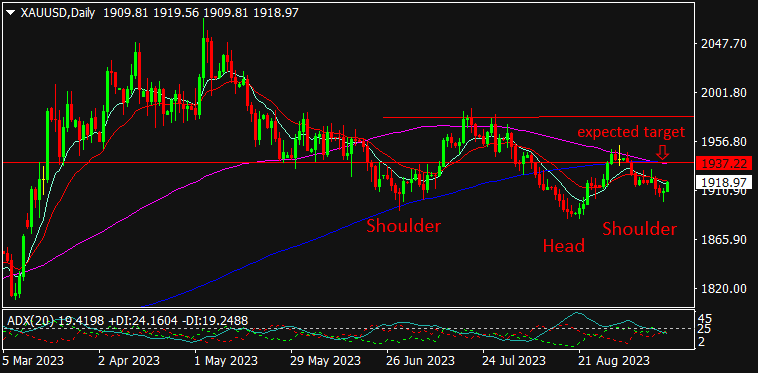

The precious metals seem to be entering into recovery zone after testing the lower levels in the last week. Majorly, the soft US Dollar as traders & investors expects a no change in upcoming Fed’s monetary policy which is to be held in next week on September 20,2023 led the buying momentum in gold & silver. The U.S issued a mild rise in CPI rate by 0.3% which prove to be insufficient for monetary tightening & hence, contributed to chances of less hawkish Fed outlook. Besides this, the recent move of Chinese PBoC of cutting down its Reserve Requirement Ratio (RRR) by 25bps in order to support the economic conditions may revive the consumption demand of gold. This may poise to be a bullish factor for gold prices since China is a major consumer of metals. On contrary, ongoing trade tension between U.S & China over technology sector may remain significant for gold prices. As seen in the chart, the inverted Head & Shoulder pattern seems to be forming; with the price currently trading near short-term Moving Averages of 10 & 20. If breached, a strong breakout can be expected in gold with the next possible targets of $1937-$1940 which are MA (100) & MA (200) points. Further buying pressure may lead the gold to test the medium to long-term targets of $1980-$1985 levels. Buying bias may be recommended on each & every corrective dip in gold.

Read More… Read LessWeekly Outlook

GOLD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 2025.16 |

| R2 | 1973.2 |

| R1 | 1941.51 |

| Turnaround | 1921.24 |

| S1 | 1889.57 |

| S2 | 1869.55 |

| S3 | 1817.32 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)