Request A Call Back

Register Real Account

Register Demo Account

Non-Farm Payroll (NFP) Data Forecast

By XFlow Team Friday, Sep 1, 2023 | World News

Uncertainty hovers over upcoming Fed monetary outlook in the month of September as the traders & investors hope for no change in interest rates. However, the recent Fed Jerome Powell speech at Jackson Hole Symposium hinted for more rate hikes in order to control the rising inflationary pressure. Besides this, the China unveiled new measures to support the stock market & property sector which might improve economic conditions & hence boosted up the equity markets. On data front, the traders will be looking forward to the result of U.S Non-farm payroll data release which to be issued on September 01, 6.00pm IST, Friday & will show a change in the number of employed people during the previous month, i.e., August, excluding the farming industry. The higher the employment, the higher the inflation rate & vice-versa. The controlled inflation rate may signal for slower & smaller rate hikes in U.S.

The report expects a mild rise in employment figure by 169K lower than previous reading of 187K & an Unemployment Rate may remain steady at 3.5%.

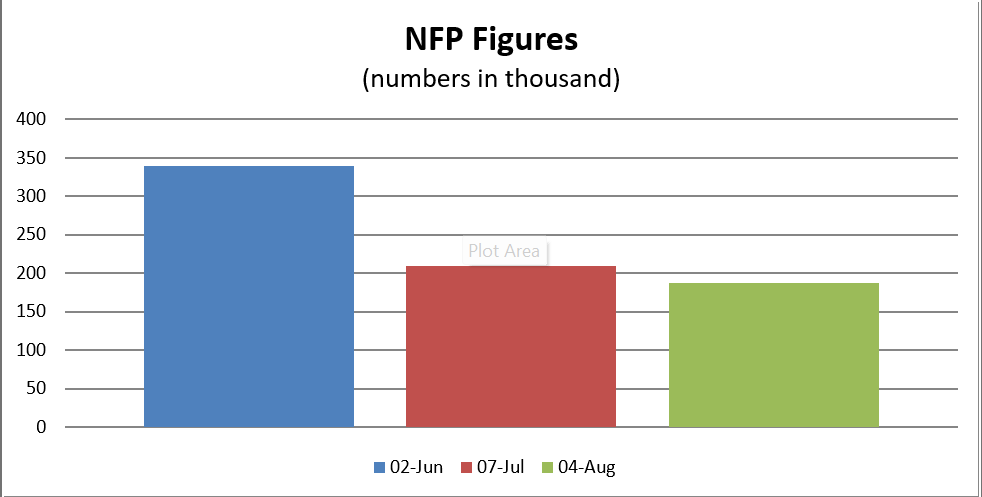

Below is the Graph showing the changes in Employment data since last three months.

Above graph shows slowing progress in employment sector in last three months.

On Wednesday, the U.S ADP Employment Change estimates fell to 177K lower than the previous month’s reading of 371K whereas the Jobless Claims rose to 228K against expectation 236K.

If NFP data comes out to be stronger, then the possible effect can be – strong US Dollar Index, soft precious metals & stronger global indices. Other way round, if data shows downbeat results, then downside in indices & buying bias in Gold can be noticed.

XFlow Team

Related News & Updates

🔔 NFP (Non-Farm Payrolls) Forecast for December 2023 📈

Non-Farm Payroll Data Forecast Optimism over dovish Fed future monetary stance made the equity markets & major currencies to trade at higher levels as compared to the first half of Continue reading

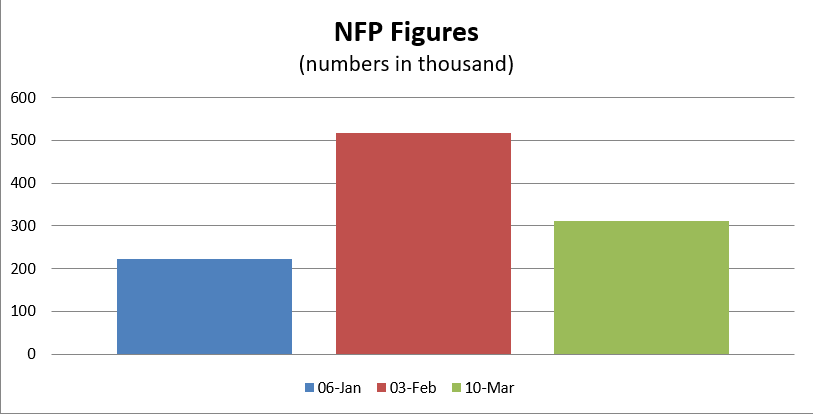

Latest NFP (US Non-Farm Payroll) Data Prediction for the Month of March 2023

US Non-Farm Payroll Data Forecast For the Month Of March 2023 The strong global cues have widely turned bullish for U.S & other major equity markets throughout the month. Majorly, Continue reading

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)