Request A Call Back

Register Real Account

Register Demo Account

Non-Concluding U.S Debt Ceiling Talks Dragged Down Gold Prices & Cushioned USD

By Research Team Tuesday, May 23, 2023

- 9.22amd1

- High1.24465

- Low1.24257

- Close1.24345

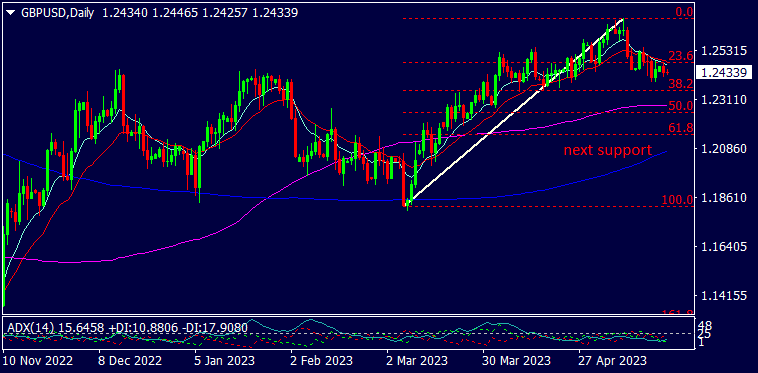

GBP/USD is trading at 1.24302, 0.02% down since previous day close. The strong USD as debt ceiling negotiations between U.S President Biden & House speaker McCarthy leads to no deal on Monday made the other currencies weaker. The U. K’s Rightmove HPI grew by 1.8% from 0.2% in the previous month & the GFK Consumer Confidence fell by 27 from 30 in the previous month. The traders will be looking forward to the result of PMI figures which will be out today. Earlier, the pair weakened on account of chances of higher interest rate hike amid higher U.S inflation rate & strong employment figures. As seen in the chart, the pair crossed down the short-term MA (10) & MA (20) & may test the Fibo level 38.2 if downside prevails further for the day.

Read More… Read LessDaily Outlook

GBP/USD

| Intra Day | |

| Near Day |  |

Technical Levels

| R3 | 1.25685 |

| R2 | 1.25050 |

| R1 | 1.24693 |

| Turnaround | 1.24415 |

| S1 | 1.24058 |

| S2 | 1.23780 |

| S3 | 1.23145 |

By Research Team Tuesday, May 23, 2023

- 10.02amd1

- High72.6

- Low72.16

- Close72.29

FRA40 is trading at 7449.3, 0.09% up since previous close. The tight range can be seen in FRA40 since last few sessions amid mixed outlook towards U.S debt ceiling issue as U.S President Biden & House Speaker McCarthy ended up the talks with no deal on Monday. The fear of chances of aggressive interest rate hikes in near future amid higher inflation rate & higher employment rate remain significant for world indices. The trend in FRA40 is widely dependent on the outcome of Manufacturing & Services PMI figures which are to be issued today. As seen in the chart, the index is consistently taking a support of short-term Moving Averages & is hovering near Fibo level 61.8. Wait & watch strategy may be built up for the day in FRA40.

Read More… Read LessDaily Outlook

FRA40

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 7544.00000 |

| R2 | 7455.00000 |

| R1 | 7423.00000 |

| Turnaround | 7366.00000 |

| S1 | 7334.00000 |

| S2 | 7277.00000 |

| S3 | 7188.00000 |

By Research Team Tuesday, May 23, 2023

- 10.02amd1

- High72.6

- Low72.16

- Close72.29

WTI Oil is trading at $72.28, 0.02% up since previous day close. The mixed trading can be seen in Oil prices on Tuesday amid global cues as U.S debt ceiling negotiations failed to show any concluding result on Monday. Earlier, the prices retreated on rising fear of slowing consumption demand & higher supplies across the globe. On Friday, the Baker Hughes showed a fall in Oil rig counts by 11 leading to 575 from 586 in the previous week. The weaker Chinese economic figures may turn out to be negative for Oil prices since China is a major consumer of Oil. As seen in the chart, the Oil is trading near MA (20) which acts as major resistance level & hence, the cautious trading may be recommended further.

Read More… Read LessDaily Outlook

WTI Oil

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 75.50000 |

| R2 | 73.70000 |

| R1 | 73.01000 |

| Turnaround | 71.83000 |

| S1 | 71.14000 |

| S2 | 69.96000 |

| S3 | 68.09000 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)