Request A Call Back

Register Real Account

Register Demo Account

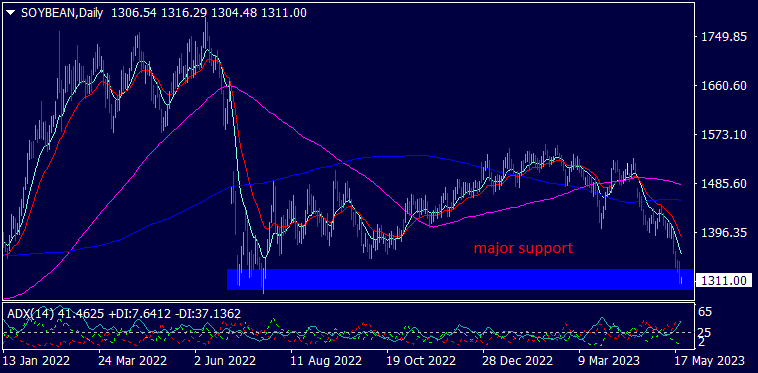

Soybean Extends Losses While Metals Trades Sideways

By Research Team Monday, May 22, 2023

- 11.41amd1

- High1316.29

- Low1304.48

- Close1311.28

SOYBEAN is trading at $1306.03, 0.09% down since previous day close. The tight range can be seen in Soybean prices after plunging down to lower levels of $1300 last week on account of mixed global cues. Majorly, the rising supplies against the steady demand across the globe led selling bias in Soybean prices. The recent weekly USDA report showed a rise in exports & supplies for the week which turned out to be negative for prices. The change in weather conditions in Brazil may increase the plantation & harvesting of beans in future course of time which may lead to excess supply & hence, causes downfall in Soybean prices. Selling bias on higher levels may be suggested in the commodity.

Read More… Read LessCommodities

SOYBEAN

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1396.2 |

| R2 | 1357.7 |

| R1 | 1332.36 |

| Turnaround | 1319.18 |

| S1 | 1293.5 |

| S2 | 1280.6 |

| S3 | 1242.1 |

By Research Team Monday, May 22, 2023

- 11.58amd1

- High8189

- Low8175

- Close8175

COPPER traded at $8181.3, 0.06% down since previous close. The flat opening can be seen in copper prices on Monday; however, the commodity may gain the momentum in later session as trade relations between U.S & China seems to be improving post G7 summit; for China is a major consumer of base metals. Globally, the tension over U.S debt ceiling issue as U.S President Biden & House of Representative Speaker are due to meet today; makes the commodities volatile. said to reach out a deal raising the ceiling limit in this week. The mixed USD over uncertain FOMC monetary decision in the next meeting will remain vital for copper. As seen in the chart, the Copper sustained at the previous lows which acts as a major support level & hence, slight buying bias may be seen.

Read More… Read LessCommodities

COPPER

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 8473 |

| R2 | 8364 |

| R1 | 8301 |

| Turnaround | 8255 |

| S1 | 8192 |

| S2 | 8146 |

| S3 | 8146 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)