Request A Call Back

Register Real Account

Register Demo Account

GBP Rises on Economic Data, Silver Reacts to Demand, US30 Volatile on Indicators and News.

By Research Team Wednesday, Apr 24, 2024

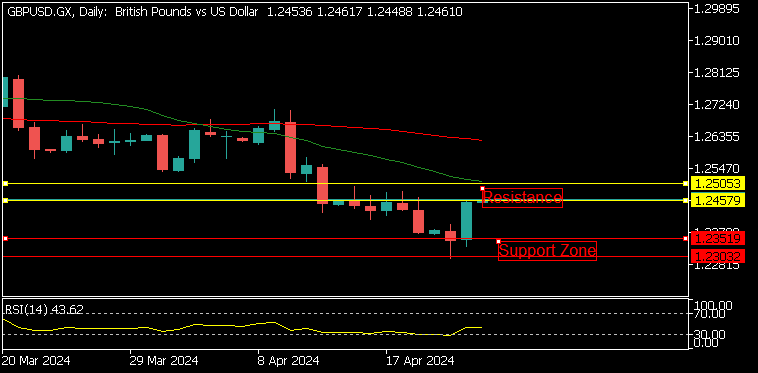

- 11.35amD1

- High1.2457

- Low1.2331

- Close1.2453

GBP/USD is trading at 1.2458, 0.82% up since previous day close. The British pound strengthened against other major currencies in the European session on Tuesday, after a survey showed that U.K. private sector activity expanded for the sixth consecutive month In April. U.K. public sector borrowing declined in the financial year ending March but it remained well above the official estimate. On daily chart this pair move out from support zone after continues declined this momentum may continue till rate cut related news from European Bank and Bank England.

Read More… Read LessDaily Outlook

GBP/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.251 |

| R2 | 1.2505 |

| R1 | 1.2457 |

| Turnaround | 1.246 |

| S1 | 1.235 |

| S2 | 1.2303 |

| S3 | 1.24 |

By Research Team Wednesday, Apr 24, 2024

- 11.30amD1

- High38590

- Low38240

- Close38540

US30 is trading at 38550 0.69% up since previous day close. Wall street indexes closed higher for two consecutive sessions, as a recent rout in technology stocks gave way to bargain buying. The sector, along with boarder benchmark indexes. Electric car maker Tesla Inc jumped 12.4% in aftermarket trade to a nine-day high. on daily chart US30 is above from their support zone may this bullish momentum continue till tech earing published.

Read More… Read LessDaily Outlook

US30

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 38950 |

| R2 | 38760 |

| R1 | 38600 |

| Turnaround | 38500 |

| S1 | 38278 |

| S2 | 38128 |

| S3 | 38000 |

By Research Team Wednesday, Apr 24, 2024

- 11.40amD1

- High27.36

- Low26.64

- Close27.26

SILVER is trading at 27.40, 0.42% up since previous day close. After sharp declined from 28.63 on Monday in the fear of war prices saw a modest uptick of 0.12%, closing at 80678, as investors regained confidence in riskier assets following a de-escalation of Middle East tensions. Iran’s downplaying of the Israel attack helped ease geopolitical concerns, prompting a shift towards risk-on sentiment. However, the dollar strengthened to around six-month highs due to hawkish Fed commentary, dampening demand for dollar-denominated metals like silver.

Read More… Read LessDaily Outlook

SILVER

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 28 |

| R2 | 27.8 |

| R1 | 27.4 |

| Turnaround | 27 |

| S1 | 27.07 |

| S2 | 26.6 |

| S3 | 26 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2024 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UAE: +971 43304431 Working hours: 7:00 AM - 5:00 PM (GMT+0)