Request A Call Back

Register Real Account

Register Demo Account

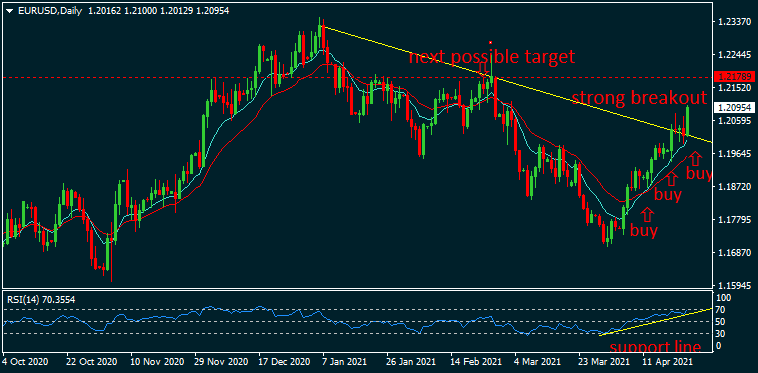

📢 Trading Idea on EUR/USD

By Research Team Sunday, Apr 25, 2021

- 11.00am ISTD1

- High1.21

- Low1.20129

- Close1.20954

The weakening greenback & soaring U.S bond yields turned out to be supportive for other basket of currencies; especially the single currency, EURO. The worsening Covid-19 situation across the globe which may affect the pace of economic recovery eases down the USD; contributes to bullishness in EUR/USD. Also, the fear looms over rising inflation & the continuation of adopting accommodative monetary policy by the U.S Fed led the currencies higher. On regional terms, the European Central Bank (ECB) left an interest rate steady as expected but hinted QE tapering once Euro-zone achieves targeted growth rate post-Covid-19 aftermath. This slightly tanked down the EUR/USD; how-so-ever that remained short-lived & resumed an upside. The better than expected Euro-zone PMI figures show an improvement in manufacturing & industrial activities as compared to last week amid progressive supply of Covid-19 vaccine doses in the country further adds upside in EUR/USD. As seen in the chart, the pair strongly crossed down the bearish trend-line forming higher tops & higher bottoms. This indicates further upward momentum & hence, buying on corrective dips may be recommended with the next possible target of 1.21700 levels on a short to medium-term basis.

Read More… Read LessWeekly Outlook

EUR/USD

| Intra Day | |

| Near Day |

Technical Levels

| R3 | 1.2744 |

| R2 | 1.23567 |

| R1 | 1.22262 |

| Turnaround | 1.19694 |

| S1 | 1.18387 |

| S2 | 1.15821 |

| S3 | 1.11948 |

XFlow Markets provides an entirely transparent access to the FOREX Market through two powerful trading platforms (XFLOW & MT4) with excellent execution speed, a 24/5 client support system with no dealing desk involvement.

-

About

-

Trading

-

Promotion

Other

© 2023 XFlow Markets, All rights reserved.

Risk Warning: Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances.

You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.

XFlow Markets INC is incorporated in Saint Lucia with registration no. 2023/C088 governed by the Companies Act, Cap 13.01 of the revised laws of Saint Lucia.

XFlow Markets does not offer Contracts for Difference to residents of certain jurisdictions including the Belgium, Iran, Canada, North Korea, the USA, Cuba, Syria and FATF Black Listed Countries.

Telephone number: UK: +44 20 38355241 | Dubai: +971 54 339 3959 Working hours: 7:00 AM - 5:00 PM (GMT+0)

Deutsch

Deutsch

Русский

Русский

Polski

Polski

中文

中文

Melayu

Melayu

Indonesian

Indonesian

ภาษาไทย

ภาษาไทย

Tiếng Việt

Tiếng Việt

Hindi

Hindi

ភាសាខ្មែរ

ភាសាខ្មែរ

العربية

العربية